Expat Service helps expats with an online tax filing service for their income tax return. Efficient, simple and affordable tax filing whenever and wherever you are in the world. That’s why Expat Service is the intelligent choice for every expat.

In the Netherlands we have different tax forms depending on your situation. Citizens in the Netherlands who have lived here for the whole year need to file a P-form. People from all over the world who did not live in the Netherlands throughout the year but did have some taxable components, like property, in the Netherlands need to file a C-form. And people who immigrated or emigrated to/from the Netherlands need to file a M-form. Now the question arises, what is a M-form and why is it different from a P-form?

A M-form is the type of tax form migrants have to file when they come to or leave the Netherlands. The M in M-form stands for migration, this way the Belastingdienst knows you were not a resident in the Netherlands for the whole year and to treat your tax return differently from a P-form. With a M-form you need to provide the Belastingdienst with some extra information relative to a P-form. You will need to provide them with the (de)registration date and any extra relevant information about your partner and your partners migration.

With a M-form you will get taxed the same as with any other form, there is no difference in taxation between the forms. It is just for the Belastingdienst to know your tax situation has changed.

There is one difference between a M-form and a P-form, and this has to do with the levy rebates. If you are a resident of the Netherlands you are entitled to the general tax credit and the labour credit. Residents with a P-form have full rights to these rebates, residents with a M-form only have the right to these rebates for the period they worked/lived in the Netherlands. So, for example, if you came to the Netherlands on the first of July, this is halfway throughout the year, you are only entitled to 50 percent of the levy rebates that you would have the right to if you would have lived in the Netherlands for the entire year. The amount of the rebates you are entitled to gets automatically calculated by our systems based on your migration date.

You have emigrated to the Netherlands on the first day of April. In the period you were living in the Netherlands you had an income of € 40.000. And you and your partner have a total of € 200.000 saved up between the two of you.

Your income of € 40.000 gets taxed just as anyone would, there are no differences in the taxation of salary between a M-form and a P-form. Where there are some differences is the taxation of your assets. In the Netherlands your assets get taxed based on what they are worth on the first of January, in this scenario this would be € 200.000. However, you are not a Dutch resident at the start of the year, so what do they do now? They calculate your tax like you have been a resident in the Netherlands for the whole year. And when the tax over the assets is calculated they make the correction for the period you have been living in the Netherlands. This way they make sure you only get taxed over the period you were living in the Netherlands, because they are not entitled to tax you for the period you were living abroad.

In this scenario, you would be entitled to 75% of the levy rebates (since you were living in the Netherlands for 75% of the year) which you can deduct from your total tax burden. The calculation for the levy rebates you are entitled to has the same structure as the calculation for the tax over your assets. They calculate the rebates you would have been entitled to if you would have been a resident of the Netherlands for the whole year and then the Belastingdienst make the correction to the actual number of days you were a resident in the Netherlands

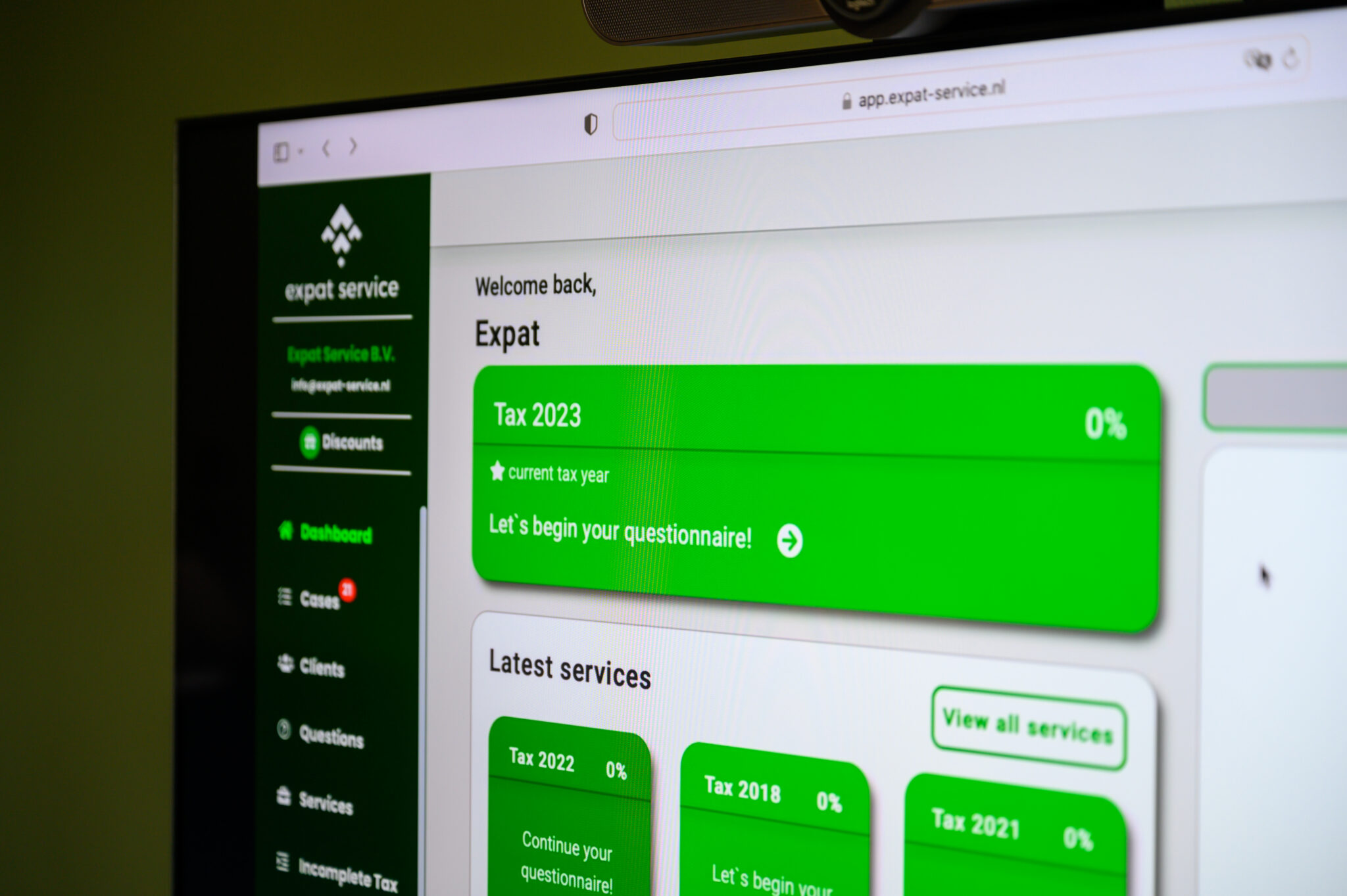

With the help of our online tax portal we have made it as easy as possible for you to complete you tax filings. We as Expat Service specialise in the taxes of expats, immigrants and emigrants and can help you optimise your tax return. If you would like to make use of our services create an account, fill in the English questionnaire and we will immediately get started on your tax return.

Get 100% tax compliant

With our unique portal, you can easily prepare your own income tax returns.

All this in only 3 easy steps.

Expat Service helps expats with an online tax filing service for their income tax return. Efficient, simple and affordable tax filing whenever and wherever you are in the world. That’s why Expat Service is the intelligent choice for every expat.

HQ Netherlands, Stratumsedijk 6 Eindhoven I KvK/CoC 80399673

Expat Service © 2025 All rights reserved.