Provisional assessment

in the Netherlands

In specific circumstances, such as purchasing a house, you might qualify for a substantial tax refund, or, if you’re self-employed, anticipate a significant tax liability by year-end. In either scenario, waiting until the end of the year to settle your taxes may not be ideal. Perhaps you require the tax refund within the current year, or you prefer not to be confronted with a heafty tax bill until you file for the year after the calender year has ended.

Fortunately, there’s an alternative. Tax authorities offer a provisional assessment, allowing you to temporarily address your tax obligations until final income data can be used to determine the accurate tax amount. By filing for a provisional tax return you can spread the tax due over the whole year instead of having to pay it all at year-end.

Apply for your provisional tax return 2025

Online service for individuals with employment income and/or other income and deductions.

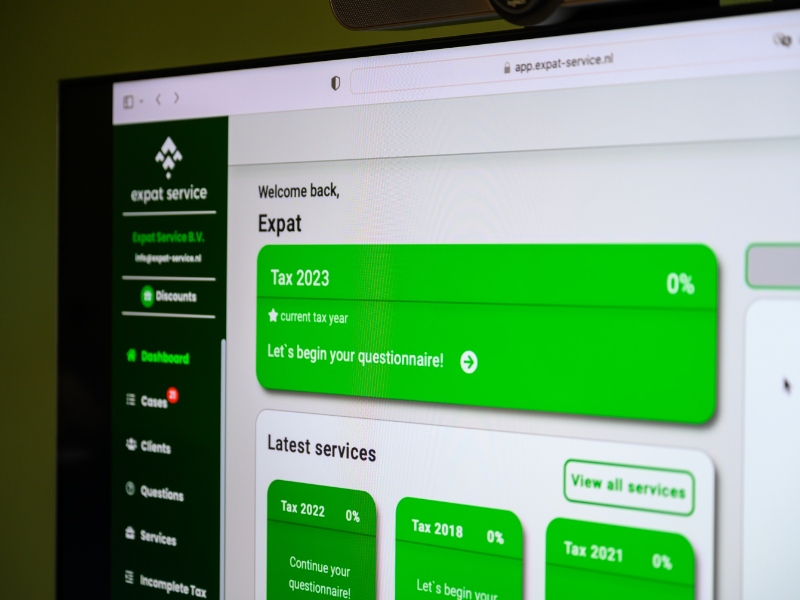

By signing up you can easily prepare your application for a Dutch provisional assessment 2025 (GDPR compliant) in 3 easy steps.

Note that you can only apply for a provisional assessment if you are an entrepreneur or can make use of certain deductions for the current tax year.

1. Sign up

2. Questionnaire

3. Approve & Submit

Need help with provisional assessment?

Do you have questions about applying for a provisional assessment or other tax-related questions? Then easily schedule an online consultation with one of our tax experts.

What is a provisional tax assessment?

A provisional assessment is essentially an advance payment of your income tax. It allows the Dutch tax authorities to collect part of your income tax and social security contributions in advance, based on an estimated income for the upcoming tax year. If you are employed, your employer already withholds part of your income tax via the wage tax. If you are an entrepreneur, you have to do this yourself. A provisional assessment can therefore help you make sure that tax payments go smoothly throughout the year, so that you don’t have to pay big redemptions at the end of the year.

Until when can I apply for a provisional assessment or change it?

Whether you need to submit an income tax return for the relevant year determines your eligibility for applying for a provisional assessment.

If you are required to submit a tax return, you have the option to apply for a provisional assessment before the tax return deadline specified in your tax return letter. If you’ve been granted an extension, the extended deadline also applies to your provisional assessment application.

If you’re not obligated to file a tax return, you can apply for a provisional assessment until May 1st of the following year. For example, for the year 2024, you can apply until May 1st, 2025. After this date, filing a tax return directly is the only option.